Before it came for America, Chagee conquered China.

霸王茶姬 · NASDAQ: CHA · Founded 2017, Kunming, Yunnan[1]

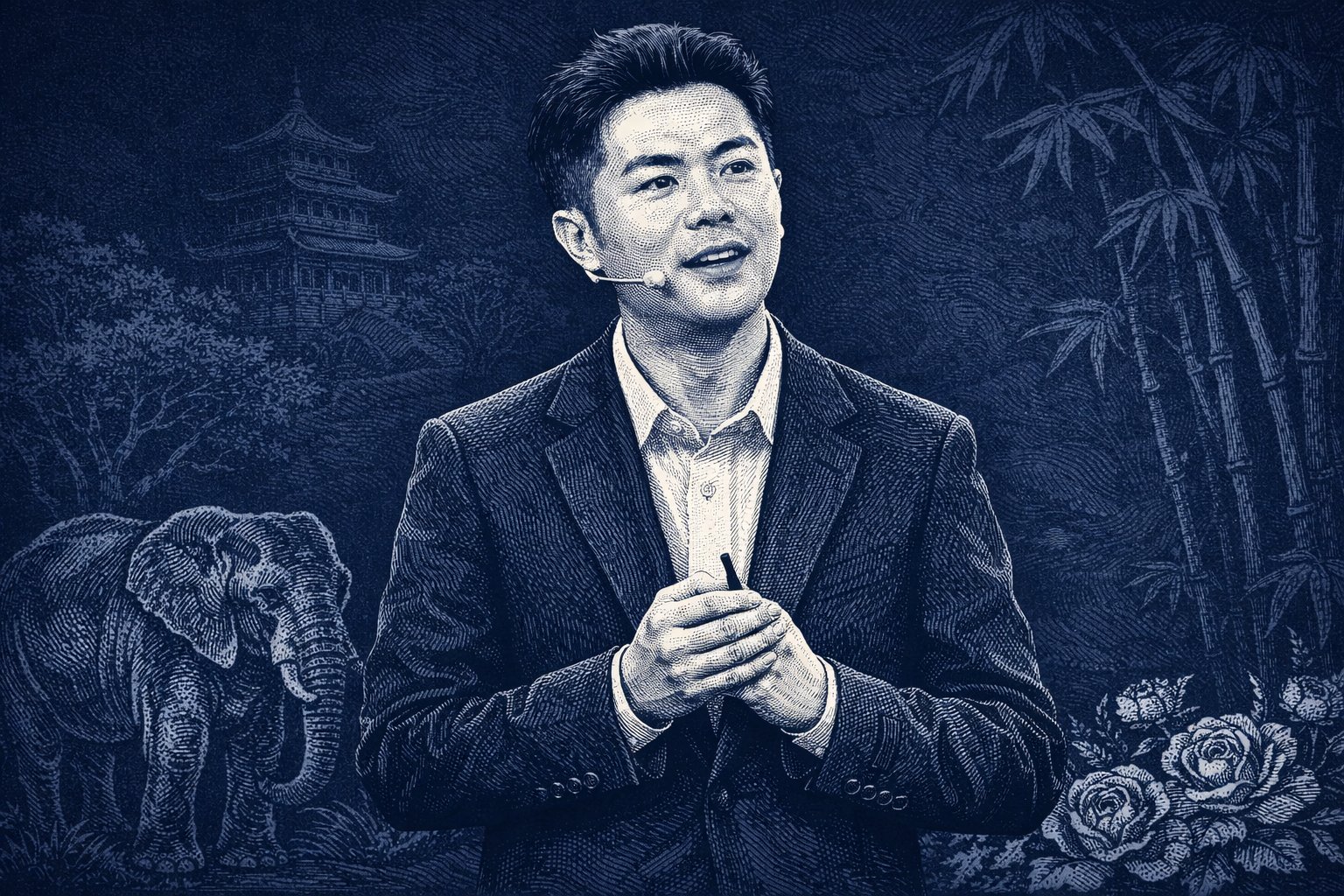

Zhang Junjie was orphaned at 10. Homeless for seven years. Couldn't read until 18. He taught himself while working 12-hour shifts at a milk tea shop in Kunming.[1]

By 24, he'd founded his own brand. By 32, he'd taken it public on the NASDAQ with a $5.1 billion valuation.[1][2]

Zhang's stated model: Starbucks. A global lifestyle brand built on one core product, operational consistency, and a "third space" experience. He wanted to be bigger than boba.

The Chinese media called it the "Oriental Starbucks." He encouraged the comparison.[1]